FAQ Crypto

-

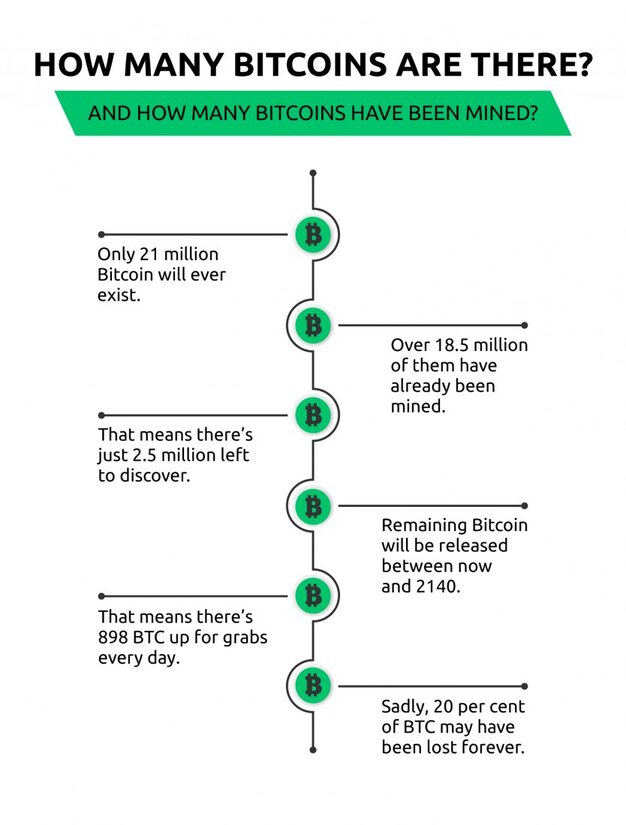

How many bitcoins are there?

There seem to be 19,012,100 bitcoins in circulation right now. When fresh coins are mined, this value changes every 10 to 12 minutes or so. Every single node now provides 6.25 bitcoin transactions to the blockchain. The quantity of coins that may be produced (mined) is limited to 21 million. Every 10 minutes, digital currencies are supplied to the Bitcoin system, which seems to be the average length of time it takes to produce a new chain of Bitcoin. 1 After every 210,000 transactions, or roughly every five years, the quantity of bitcoins manufactured every block is cut by 50% by purpose.

-

What is wrapped bitcoin?

Wrapped Bitcoin (WBTC) would be an Ethereum-based ERC-20 currency that symbolizes Bitcoin (BTC). WBTC’s connectivity with Ethereum accounts, and apps, as well as blockchain-based, is a significant benefit. 1 Bitcoin might be changed to become 1 Wrapped Bitcoin throughout a WBTC partner, and conversely. WBTC was intended to allow Bitcoin users to engage in Ethereum-based contributions to the group (“Defi”) apps. The WBTC DAO, which now has over 30 contributors, is responsible for the upkeep of WBTC. BitGo, Ren, as well as Kyber were the initial founders.

-

What is bitcoin backed by?

The only currency that lacks fundamental monetary qualities has to be backed by some other currency that does. The notion that our base and subbase money must be backed by someone or something dates back to the fiat currency period.

Bitcoin has fundamental monetary features that are superior to any previous monetary value that has ever existed; hence it does not necessarily have a backing. That’s significant whereas when individuals consider money has to be supported through something, they automatically assume it means finance needs to be accompanied by the government. It will be critical for consumers to eliminate the notion that money must be supported as we shift from the fiat era to the fractional reserve banking era.

-

When will the last bitcoin be mined?

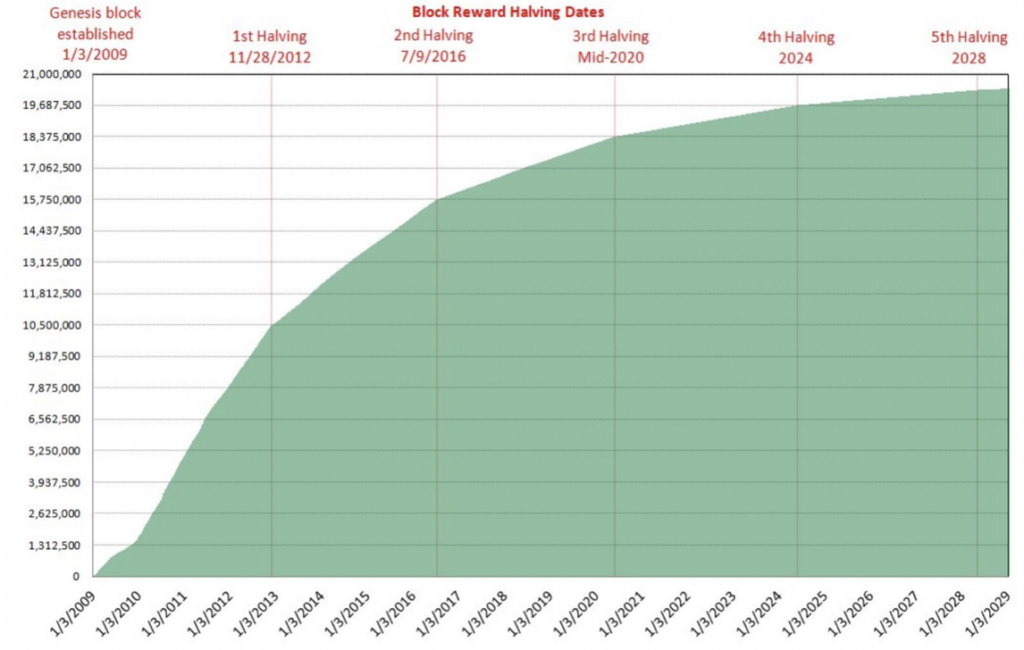

The block reward provided to Bitcoin miners when taking payments is reduced in half after 210,000 blocks are generated, or about every 4 years. The term “ halving ” refers to this occurrence. Unless all bitcoin transactions are distributed, this is Bitcoin’s approach of imposing synthetic price inflation.

This system of incentives will last until roughly the year 2140, once the intended maximum of 21 million people is achieved. Miners will be credited with fees for transferring funds, which may be paid by network operators. These fees guarantee that miners continue to be motivated to mine and maintain the infrastructure.

-

How many satoshis in a bitcoin?

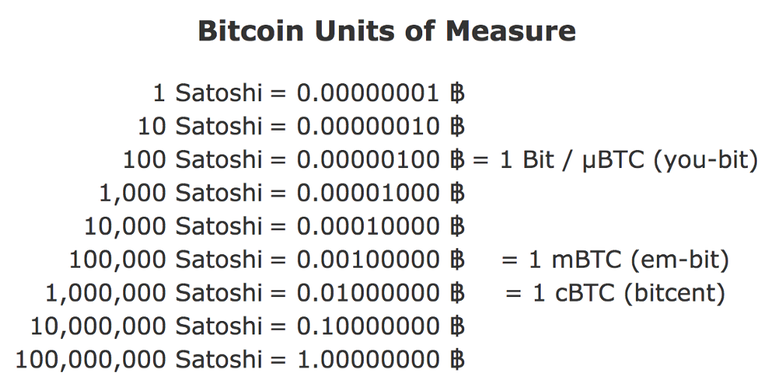

A dollar is split by 100 cents, a sterling by 100 pence, a Dollar into 10 jiao, plus an additional jiao into 10 fens. Cryptocurrency is constituted of Satoshis , which are bitcoin pieces. It seems that every Bitcoin is convertible to eight significant digits, implying that such satoshi was the hundredth equivalent to approximately a Bitcoin. To put it differently, 100 million Satoshis contribute one Bitcoins. Satoshi Nakamoto , Bitcoin’s ‘creator,’ is the namesake of the satoshi. Satoshis have recently been referred to as SATs in regular bitcoin discussions.

TABLE:

| Satoshi | Bitcoin |

| 1 Satoshi | 0.00000001 Bitcoin |

| 10 Satoshi | 0.00000010 Bitcoin |

| 100 Satoshi | 0.00000100 Bitcoin |

| 1,000 Satoshi | 0.00001000 Bitcoin |

| 10,000 Satoshi | 0.00010000 Bitcoin |

| 100,000 Satoshi | 0.00100000 Bitcoin |

| 1,000,000 Satoshi | 0.01000000 Bitcoin |

| 10,000,000 Satoshi | 0.10000000 Bitcoin |

| 100,000,000 Satoshi | 1.00000000 Bitcoin |

How to short bitcoin top 4 ways:

-

Shorting Bitcoin with Futures Contracts

When you sell a financial product, you’re indicating a negative attitude and a forecast that Bitcoin’s price will fall. In this case, you could short Bitcoin by acquiring derivatives that speculate on the cryptocurrency’s valuation falling. Futures and options allow investors to make in the Bitcoin (BTCUSD) market without owning the basic cryptocurrency. They function similarly to commodities or stock index futures transactions in that they enable participants to experiment with the cryptocurrency’s market valuation.

-

Shorting Bitcoin with Options Contracts

Bitcoin’s unpredictable price may be shorted by gambling against it via derivatives such as options and futures. However, it’s crucial to keep in mind the numerous hazards that come with shorting. A variety of offshore platforms provide financial products, but the prices (and hazards) are significant. One of the benefits of trading strategies over commodity derivatives is that you may minimize your damages by not selling your futures contracts.

-

Shorting Bitcoin on Exchanges

The most frequent way too short bitcoin is to use social exchanges that permit bitcoin shorting. Several exchanges, including Kraken , Bitfinex , and Bitmex , allow you to short bitcoin. When contrast to purchasing and owning bitcoin, exchanges that facilitate the selling of cryptocurrency are more complicated. Short positions can be opened by bitcoin speculators who believe the bitcoin prices will collapse. They would, however, get the bitcoin through a broker or maybe another appropriate lender. They trade the bitcoin as soon as they borrow it.

-

Shorting Bitcoin with Leveraged Bitcoin Trading

Leverage in cryptocurrency trading refers to making transactions with borrowed funds. Leveraged trading allows you to trade greater quantities by amplifying your sale and purchase power. As a result, even if the initial cash is little, you may leverage your transactions by using it as protection. While leveraged dealing might increase your possible benefits, it also comes with a significant level of risk, particularly in the unpredictable cryptocurrency market. When trading cryptocurrency, be cautious about employing leverage. If the market swing against your investment, you might lose a lot of money.

What is Ethereum?

Ethereum would be a decentralized ledger technology that creates a peer-to-peer community for privately executing and verifying smart contract code. Participants can transact with one another without relying on a trusted centralized authority. Ethereum is a distributed ledger used by businesses to create new applications. Both Bitcoin and Ethereum are based on “ blockchain ” technology, but Ethereum is significantly more reliable. The network’s native coinage is Ether. Ether would be the second most valuable cryptocurrency after Bitcoin in terms of market size. Vitalik Buterin created Ethereum in 2013.

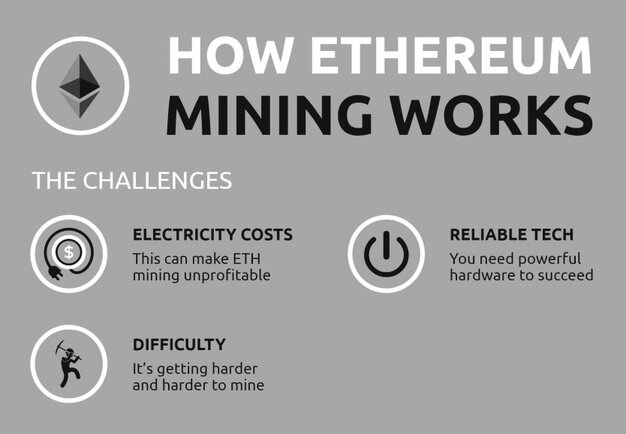

How To Mine Ethereum?

Ethereum is a decentralized digital platform based on blockchain technology. It’s most recognized for its coinage, Ether, and smart contract capability. The Ethereum channel’s overall goal is to allow decentralized applications (dApps), including nonfungible currency markets (NFTs).

Transactions in these systems are open to the public and are not governed by a centralized authority. Consequently, the Ethereum network requires a worldwide system of processors to construct and validate each batch containing operations (i.e., a transaction) within the ledger of both platforms.

A step-by-step approach to mining Ethereum

Step 1: Decide on your mining strategy.

Step 2: Create a cryptocurrency wallet.

Step 3: Make your equipment/software selections.

Step 4: Select a mining pool to join.

Step 5: Reap the benefits.

Where Can I Purchase Ethereum?

-

Decide on a crypto exchange.

You won’t be able to buy cryptocurrencies via a bank or even an online stockbroker like Vanguard or Vanguard; instead, you’ll need to utilize a crypto exchange platform.

-

Deposit into your account

Funding your wallet does not imply that you have acquired Ethereum, and like with another interest-bearing account, you wouldn’t want your unspendable funds to remain idle.

-

Place an Ethereum order

You can exchange your US bucks for Ethereum; subsequently, your wallet is filled.

-

Keep your Ethereum safe.

It’s easier to leave your crypto deposit in your existing account if you have a small quantity.

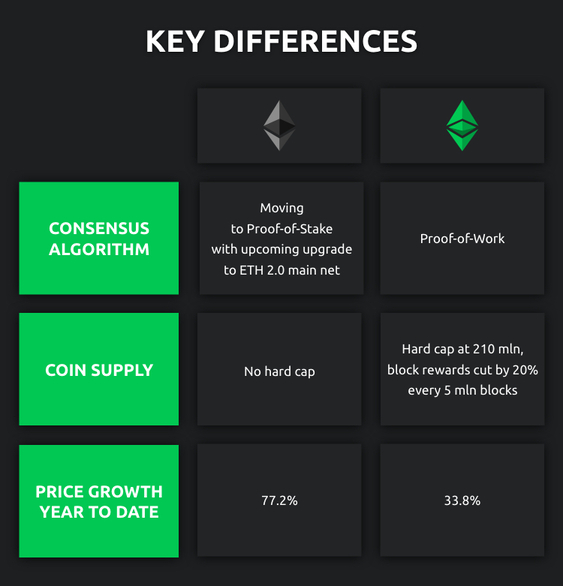

What Is Ethereum Classic?

Ethereum Classic (ETC) would be a networked currency framework that executes decentralized applications and is open-source, autonomous, and blockchain-based. The DAO, a terminology functioning on the Ethereum network, was hacked in 2016, resulting in the formation of the Ethereum Classic. The entire blockchain got divided into 2 parts, with the percent of participants opting to undo the attack and refund the monies stolen.

The split exposed schisms in the Ethereum group’s philosophy. A tiny group of engineers and miners argued that although the DAO’s shareholders should bear the repercussions of participating in a faulty enterprise, founded on the notion that the Code is Legislation.

How Many Ethereum Are There?

Approximately 117.5 million ETH tokens were in existence in September 2025; released 72 million in the blockchain network, the first-ever square on the Ethereum network. Sixty million of the 72 million have been handed to the original participants of the program’s 2014 crowd sale, while 12 million got provided to the investment program. They originally set the block reward at 5 ETH per transaction in 2015. However, it was reduced to 3 ETH in late 2017 and subsequently to 2 ETH by the earlier start of 2019. A transaction of Ethereum takes about 13-15 seconds to mine on average.

How To Stake Ethereum?

Ethereum staking would be a crucial component of Ethereum’s move to a consensus mechanism. Let’s examine why Ethereum holding is crucial and how claiming Ether on Coinbase may help you start collecting interests on your Ethereum.

The Ethereum channel’s blockchain is currently being upgraded. Today, depending only on the operation you would like to do, it will charge you somewhere between to 0 to trade on Ethereum. The system could only handle roughly 15 operations per second due to Ethereum’s proof-of-work agreement methodology. The Eth 2.0 update will increase Ethereum’s blockchain’s price and process throughput, improving the cable network’s long-term viability and stability.

What Is Dogecoin?

Two of some well digital currencies are Bitcoin as well as Dogecoin . Bitcoin is the first fiat money, but Dogecoin looked to be a joke at the time of its creation. The above two digital currencies have a lot of common ground as blockchain-based digital currencies, but they also have a lot of differences. Dogecoin was founded as a meme cryptocurrency and altcoins based on the series Shiba Inu meme, DOGE. Its main aim is to act as a medium of exchange and asset storage, with qualities like a shared ledger, integrity of information, and service availability.

How To Buy Dogecoin?

Purchasing and trading Dogecoin is a straightforward process. You may purchase it directly with other people on various platforms, although larger cryptocurrency platforms like Kraken or Binance are typically a better option. Using such systems could profit from their high trading velocity and market capitalization.

Going for a larger exchange is typically a good choice as they’re more genuine and dependable. While trying to purchase any cryptos accessible on the world wide web, we strongly advise you to familiarize familiar with the online payment.

Where To Buy Dogecoin?

DOGE can be purchased in a variety of ways. Many people, however, feel that buying it through a reputable universal economy like Kraken is the most convenient option.

Kraken is consistently ranked amongst the most stable and safe crypto markets globally and has the lowest prices in the market. It is important since recovering your cash might be difficult if you lose the DOGE private key, if not unattainable.

Kraken takes safety seriously, with tried-and-true equipment and stringent protocols to protect cash. They don’t take chances with safety, and you shouldn’t either.

How To Mine Dogecoin?

The donation of computing power, also referred to as thorough performance, to the Dogecoin system is required to contribute to Dogecoin extraction . It was feasible to process Dogecoin utilizing household CPU and GPU computing gear in the initial periods of the coinage. Due to Dogecoin’s massive rise in popularity, the system receives an increasing amount of hash power, rendering mining increasingly challenging. Dogecoin could no longer be mined effectively using a modern computing unit (CPU). To give meaningful hash power to the system, at least an impressive graphic card processor (GPU) or, better still, an application-specific incorporated (ASIC) mining computer is required.

How To Invest In Dogecoin?

You may purchase Dogecoin through a variety of websites, and which one you choose may be determined by the following factors:

If you only want to speculate with Dogecoin, you may use an online brokerage like Robinhood that enables cryptocurrency trading. Webull and eToro enable you to exchange the cryptocurrency, while many other exchanges do not.

If you want to acquire Dogecoin for speculative purposes or utilize it, you will use an exchange like Coinbase or US. Exchanges can allow you to take physical possession of the product, permitting you to transmit or spend it.

How Much Is A Dogecoin?

Its price first rose 10 on April 14 before reaching a new record .45 on April 16 (nearly 400 percent in one week), with approximately billion in trading activity in the previous 24 hours. By Jan 2018, the price of doge has risen. After an extended period of low market activity as the token’s enthusiasm dissipated, it took over 4 years to doge again to regain that level. There are, moreover, 132 billion Dogecoins in circulation globally. This figure also indicates the total amount of Dogecoins in service or the number of coins accessible to the public.